As is well known, the Western Allies have largely excluded Russia from SWIFT. In addition, Visa and MasterCard have also blocked services for Russian companies. Theoretically, the numerous Russian payment processors in the high-risk and cybercrime segment should no longer work. Many Russian payment processors operate via licensed Estonian crypto payment processors such as Volrix OÜ d/b/a SafeCurrency or Fincana OÜ d/b/a Payeer. The list of Russian-controlled Estonian crypto payment processors is long.

According to the letter of the sanctions imposed by the Western Allies and the announcements of the credit card companies Visa and MasterCard, the Russian high-risk processors should also be cut off from the West. However, in recent years, Russian citizens or organizations established licensed crypto payment companies in Estonia. The country is Russia’s neighbor and an EU member state. The Russian high-risk (dark) payment sector can easily access the Western financial system through these licensed Estonian crypto payment processors.

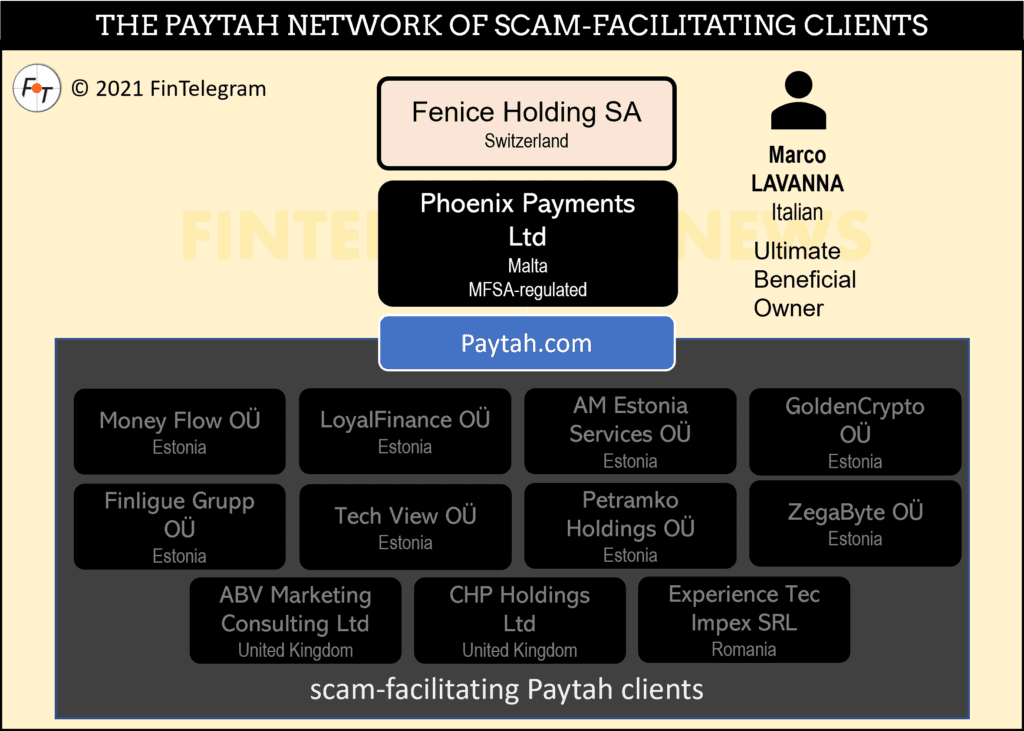

It has become known, for example, that Phoenix Payments Ltd d/b/a Paytah, which the MFSA regulates in Malta, accepted many Estonian crypto companies as clients and processed their banking transactions. Besides Estonia, the Russians have also established financial ventures in the EU offshore hotspots Malta, Cyprus, and Gibraltar.

Another example of the high market share of Russian payment processors in the dark universe of the Internet is Perfect Money, which has spread like an octopus in the high-risk and dark segment of the Internet in recent years and has partners in the US and Europe. One searches in vain on Perfect Money‘s websites for information about the operators. This information is also missing from the Russian Piastrix. In general, our experience is that Russian payment processors prefer to operate anonymously without an imprint or information on legal entities and jurisdictions.

In addition, crypto has achieved dominance as a means of payment, especially in the high-risk and illegal sectors. The licensed Estonian companies position themselves as a link between Crypto and FIAT. Licensed Estonian companies still have access to VISA or MasterCard and the Western financial system. No doubt about that.

Therefore, we must assume that Western sanctions have not interrupted the illegal payment processes between the West and Russia. Ironically, Ukraine and Russia have been close allies in the cybercrime sector and jointly attacked Europe with their boiler rooms and illegal payment services.