The world’s largest crypto exchange, Binance, led by founder Changpeng Zhao, is reportedly assisting Russians in moving funds abroad through its partnership with Advcash, FinTelegram FinTelegram reports. This situation could exacerbate Binance’s existing legal issues in the United States, as detailed by The Wall Street Journal. Despite initially scaling down operations in Russia due to the Ukrainian conflict, Binance continues to manage substantial ruble trading volumes through intermediaries.

The Russian Link

Clients can convert funds from sanctioned banks into balances on the Binance platform. This enables peer-to-peer trades involving rubles for digital tokens, often entailing banks on Western sanctions lists. Advcash, a payment processor under Russian control, plays a crucial role in this process.

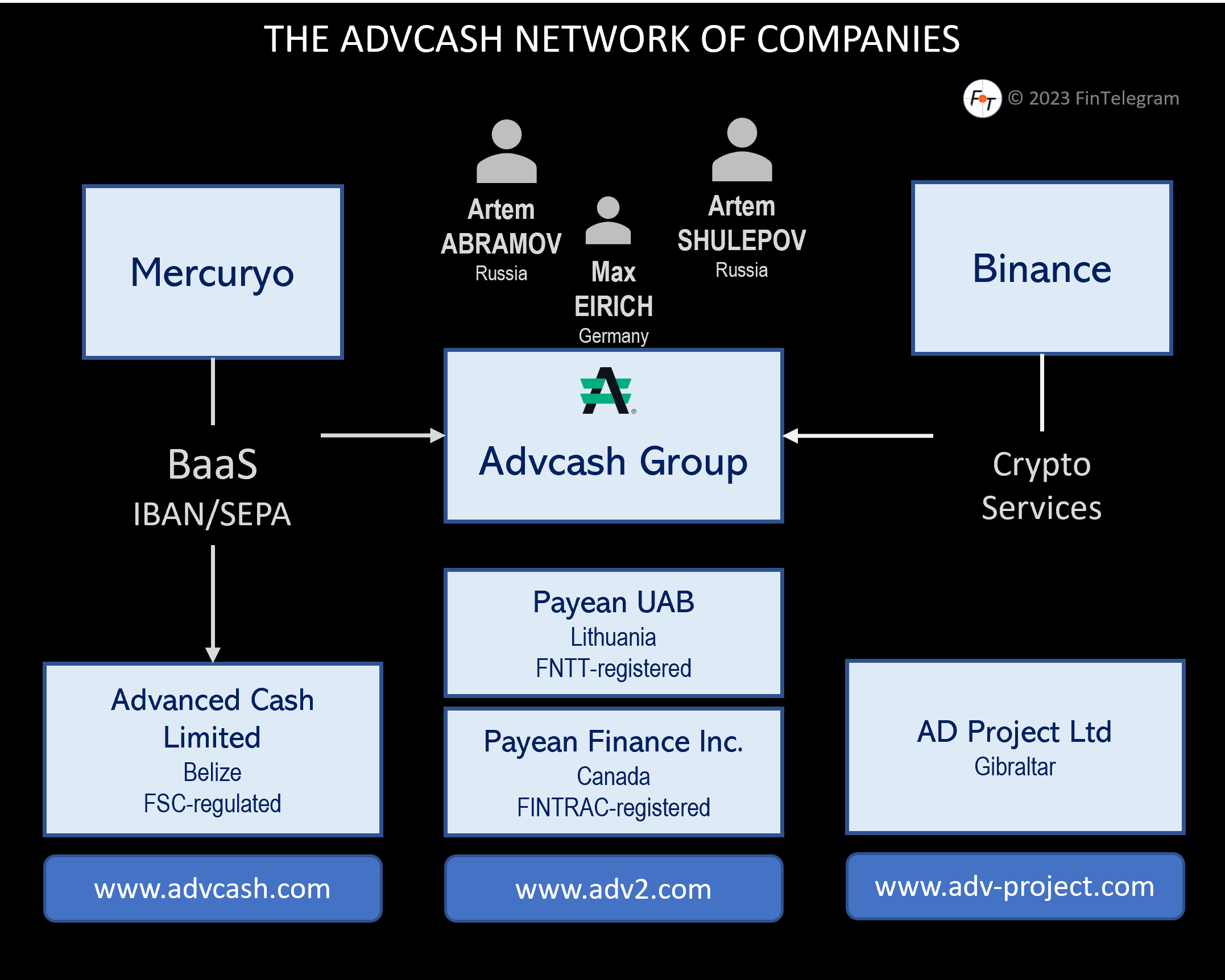

Officially based in Belize, Advcash has drawn attention for facilitating financial transactions. Having partnered with Binance in 2019, it discreetly aids Russians in navigating the traditional financial system when dealing with cryptocurrencies. Advcash acts as a bridge, permitting users to access funds from ruble-denominated accounts at banks like Rosbank and Sberbank, despite the latter facing sanctions.

By collaborating with “independent exchange providers,” Advcash enables seamless fund transfers from Russian banks to their platform, which can then be further transferred between Advcash and Binance accounts. While Advcash asserts its compliance with anti-money laundering and know-your-client regulations, internal concerns within Binance regarding operational transparency have been raised. Binance insiders have expressed uncertainties about Advcash‘s operations due to ambiguities surrounding its executives and ownership.

As an intermediary between conventional financial institutions and the cryptocurrency realm, Advcash‘s practices warrant scrutiny, especially concerning its handling of ruble processing and interactions with sanctioned banks. The company’s role sparks inquiries about its responsibilities within the broader landscape of financial innovation and regulatory adherence.

Advcash currently collaborates with almost all major payment platforms. For instance, ByBit also utilizes Advcash, providing a means for Russians to bypass Western sanctions, as reported by FinTelegram.

Legal Troubles Over Western Sanctions

The Advcash situation coincides with the U.S. Justice Department’s investigation into Binance for potential breaches of U.S. sanctions on Russia. This compounds Binance‘s existing legal challenges, including suspected anti-money laundering activities and compliance issues.

Binance‘s involvement in facilitating Russians’ financial movements abroad raises concerns about its adherence to global sanctions and regulatory requisites. The ongoing U.S. Justice Department investigation, combined with Binance‘s growing legal predicaments, highlights the intricate landscape that cryptocurrency exchanges navigate, striving to balance innovation and regulatory compliance.

.