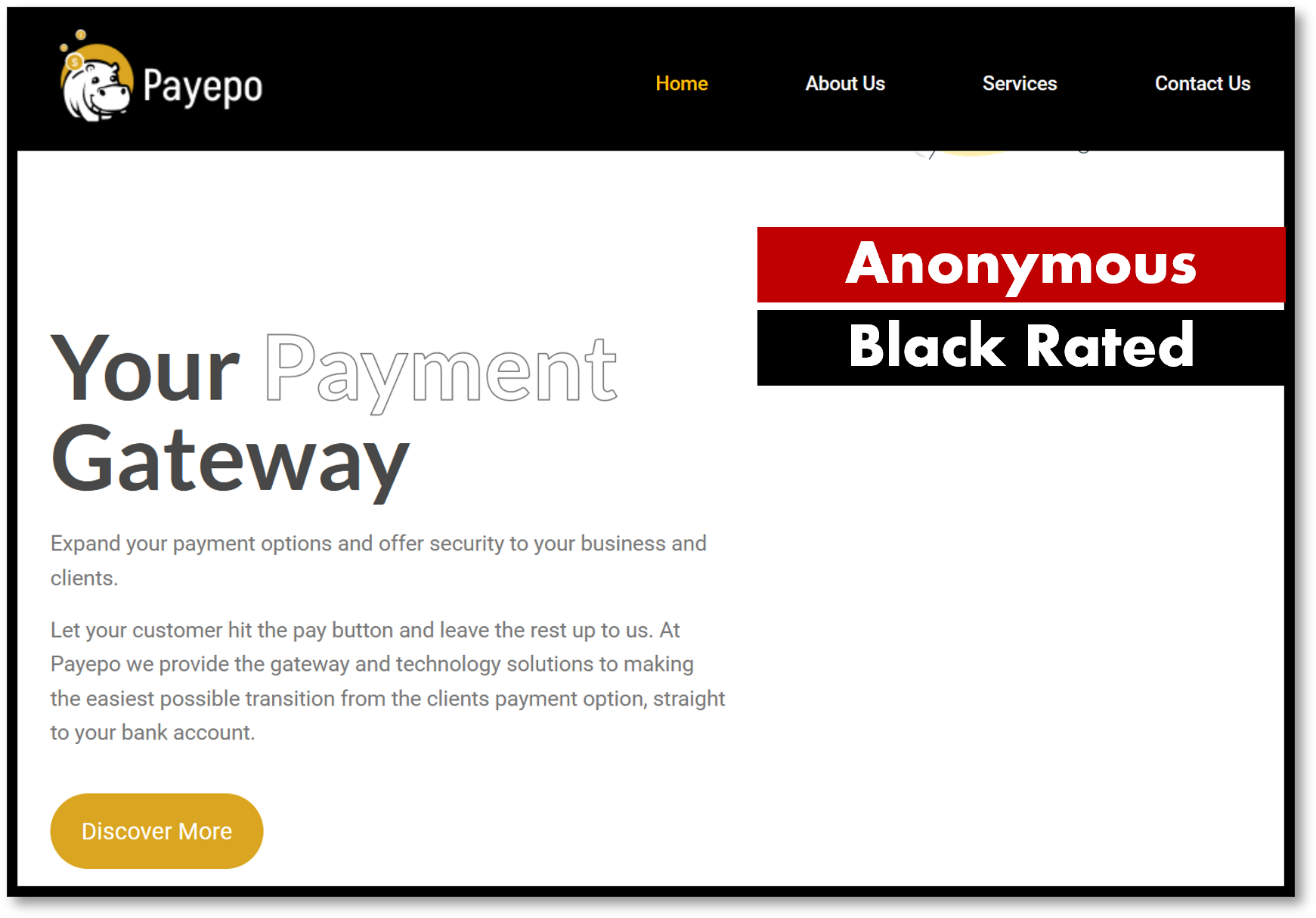

The Cyberrating agency PayRate42 has placed Payepo on its Black Compliance list for failing to provide owner, operator, and management information. The agency has advised merchants against working with the payment processor. There are a few very good reasons for merchants and their clients to work only with payment processors that provide all the information:

- Legal Compliance:

- Anti-Money Laundering (AML) and Countering Financing of Terrorism (CFT): Many jurisdictions have AML and CFT regulations that require businesses, especially financial institutions, to have transparent ownership and management structures. This helps authorities trace and prevent illegal activities.

- Licensing and Regulation: Online payment services often need licenses to operate. Regulatory bodies require detailed information about the owners and management to ensure they meet the criteria for operating such a service.

- Consumer Protection:

- Accountability: Knowing who’s behind an online payment service ensures that there’s a party accountable in case of disputes, malpractices, or failures.

- Fraud Prevention: Transparency about ownership and management can deter fraudulent entities from setting up scam operations. It gives consumers a sense of security knowing that they can verify the legitimacy of the service.

- Data Protection: Given the sensitive nature of financial data, consumers want to know who handles their data and how. Knowing the management and their practices can instill confidence in users about data protection measures.

- Business Considerations:

- Building Trust: Transparency is a key trust-building factor. When users know who’s behind a service, where it’s based, and under which jurisdiction it operates, they’re more likely to trust and use the service.

- Partnerships and Integrations: Other businesses and financial institutions may be more willing to partner or integrate with a transparent online payment service. This can lead to expanded services and increased user base.

- Jurisdictional Clarity:

- Legal Recourse: By knowing the applicable jurisdiction, users and partners have clarity on the legal framework governing the service. This is crucial in case of disputes, as it determines which laws apply and where legal actions can be initiated.

- Regulatory Compliance: Different jurisdictions have different regulations. By declaring their jurisdiction, online payment services signal their compliance with specific sets of regulations, which can be reassuring for users.

- Operational Transparency:

- Operational Practices: By being transparent about management, online payment services can also communicate their operational practices, ethos, and values, which can be a differentiating factor in a competitive market.

- Risk Management: Transparency can also be a part of the service’s risk management strategy. By being open about ownership and management, they can preemptively address concerns and reduce potential risks.

In summary, providing information about the owners, management, and jurisdiction is not just a legal requirement for online payment services but also a strategic move to build trust, ensure accountability, and foster growth.

Share Information

Share Information

If you have any information about Payepo or other payment processors acting anonymously, please let us know via our whistleblower system, Whistle42.