Recently we reported about BridgerPay‘s new search engine, Bridger Connections. Merchants can search for suitable payment processors for free, which is an attractive offer, especially for high-risk merchants. However, the quality and compliance of the integrated payment processors are apparently not checked by BridgerPay. The high-risk payment processor EU Paymentz was listed with false regulatory information. Moreover, EU Paymentz does not provide the required legal information and is on PayRate42‘s “Red Compliance” list.

We took a closer look at the payment processors included in Bridger Connections. A few days ago, for example, BridgerPay proudly announced on LinkedIn that they had now connected Bulgarian EU Paymentz to the payment gateway and included it in its Bridger Connections search engine (profile). However, the high-risk payment processor, founded in 2015 by Chris Ortega, fails to provide legally required information on its website. No imprint is given, and information about the details of the legal entity or ownership (the “Company”) is missing.

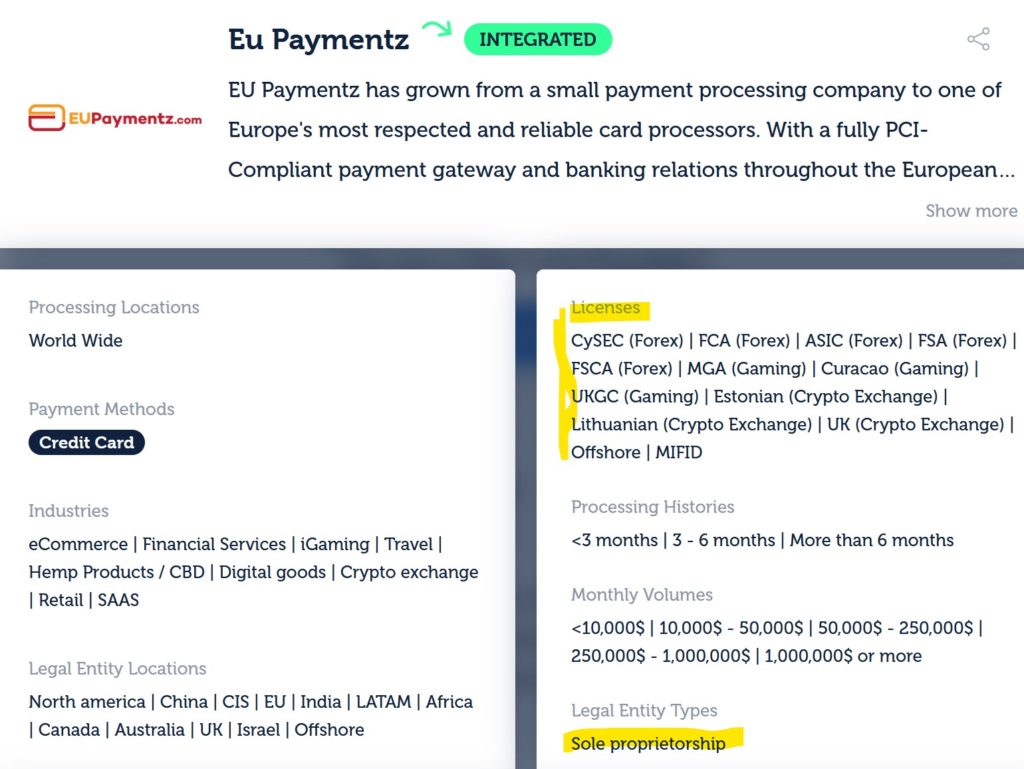

According to the LinkedIn profile of Chris Ortega, EU Paymentz LLC in Delaware would be the operator. However, the EU Paymentz website (www.eupaymentz.com) says that an unnamed company in Sofia, Bulgaria, would be the operator. In the BridgerPay search engine, EU Paymentz is listed as “sole proprietorship.“

In addition, the BridgerPay profile states that EU Paymentz would have diverse licenses in various regulatory regimes. This includes a CySEC and an FCA license. This is complete bullshit, false and misleading information, and obviously a massive error in the Bridger Connections database.

PayRate42 included EU Paymentz on the “Red Compliance” list due to this missing compliance information and the founder’s history.