MoneyNetint, the FCA-regulated Israeli e-Money institution around Yishay Trif and Raphael Golan, announced a new payment service for merchants doing business with Brazil. Together with Banco Rendimento in Sao Paulo, a clearing system based on the RippleNet blockchain is to be launched. This is intended to enable payments to Brazilian companies and individuals to be made without friction and at low cost. The system is compatible with the Brazilian instant payment system PIX, MoneyNetint claims in its blog post.

The scam facilitator legacy

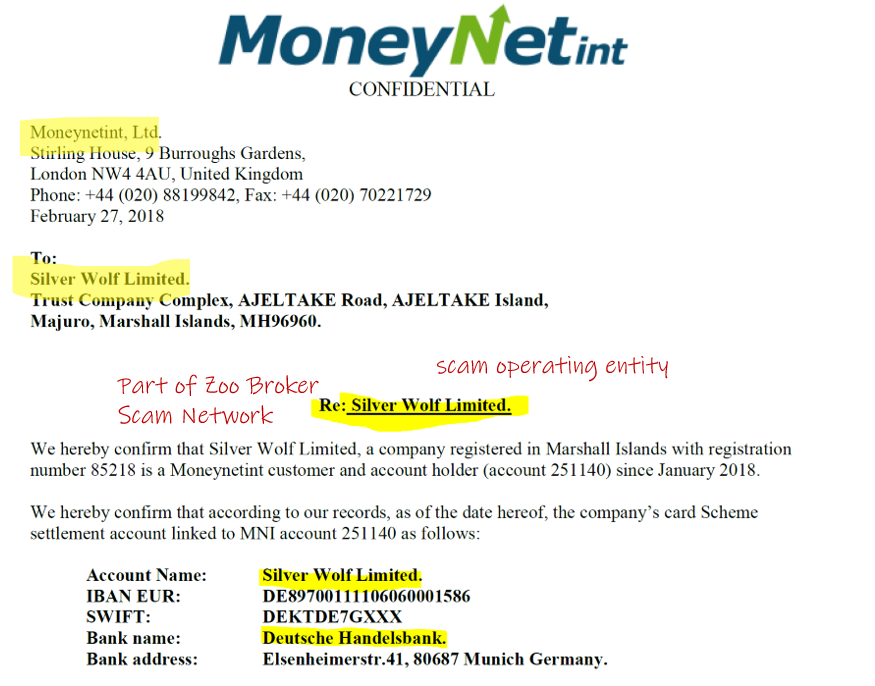

MoneyNetint Group operates through its two regulated entities MoneyNetint Ltd (MNI) in the UK and GlobalNetint UAB (GNI) in Lithuania. MoneyNetint is certainly one of the leading Israeli FinTechs in the high-risk payment sector. During the fraudulent binary options industry, the group facilitated dozens of scam operators. One client was Silver Wolf Limited in the Marshall Islands (Screenshot left) which was part of the so-called “Zoo Broker Scam Network” and operated numerous large broker scams.

The Lithuanian troubles

While the sun shines on its business in Brazil, however, the group has massive problems with its GNI in Lithuania. We have heard from reliable sources that in connection with allegations of massive money laundering and data leaks, investigations are underway by the Bank of Lithuania as well as the relevant law enforcement authorities. A statement from Michel Farah-Haroutunian (LinkedIn profile) requested by FinTelegram has not yet been responded to.

We will bring an update on the GNI and MoneyNetint Group with more details shortly. Stay tuned!