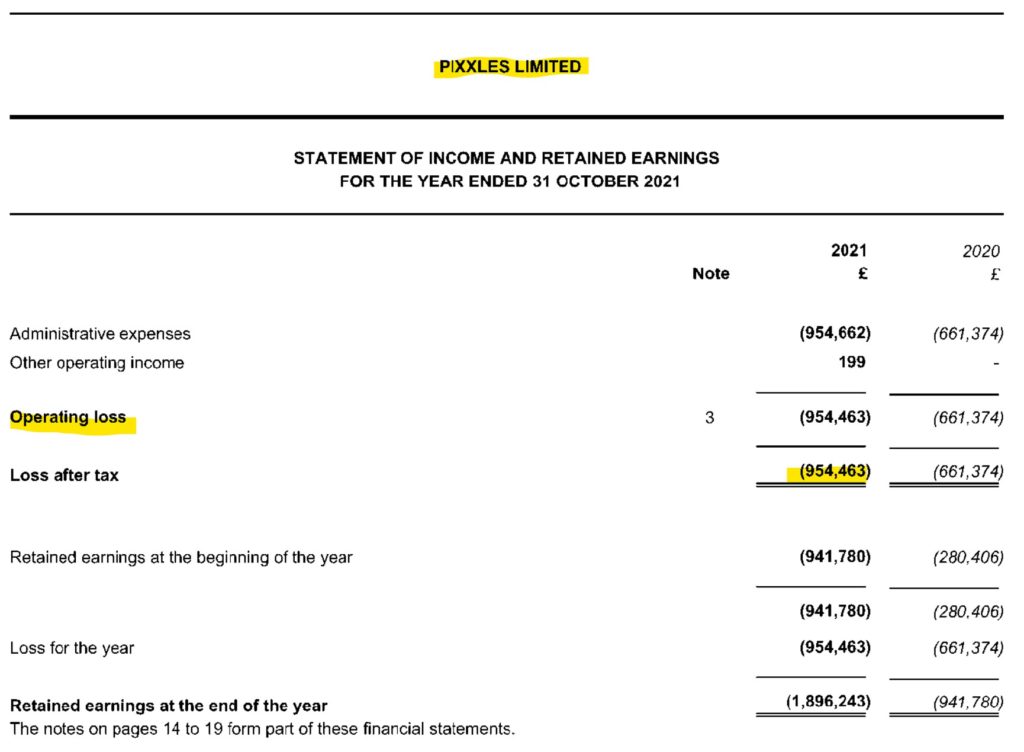

Pixxles is a spin-off of the notorious US high-risk payment processor T1 Payments. FCA-regulated since June 2021, the e-money institution is led by former T1 Payments executive Amber Fairchild, once the fiancée of T1 Payments founder and CEO Donald Kasdon. PayRate42 downgraded Pixxles because of its financial performance. The company’s 2021 financials show a heavy operating loss and an substantial cash burn rate, which had to be covered by issuing new shares.

Short Update

The 2021 operating loss of £954,463 and the corresponding negative net cash flow of £431,610 had to be financed by the issuance of new shared in the amount of more than £1 million in March 2022.

The cyberfinance rating agency PayRate42 downgraded Pixxels to “Orange” because of its financial performance.

In the Pixxles Strategic Report, Amber Fairchild is very pleased with the number of LinkedIn followers, click through rates and results from YouTube campaigns. However, more than a year later, in November 2022, this is not visible in the available statistics. On LinkedIn, EMI has just under 600 followers, and on Twitter and Instagram, not even 1,000. That can’t be called performance for a payment processor that focuses on digital merchants.

Visited by not even 6000 people a month according to Similarweb. This is actually nothing and indicates that there is hardly any business yet.

Key Data

| Trading name | Pixxles |

| Domain | www.pixxles.com |

| Social media | LinkedIn, Twitter, Facebook, YouTube |

| Legal entity | Pixxles Ltd (UK) Pixxles LLC (US) PXLS LLC (US) |

| Jurisdiction | United Kingdom |

| Regulator | UK FCA with reference no 927960 |

| Related individuals | Amber Fairchild, US Scott Dawson, UK (LinkedIn) Salma Kamaly, UK |

| Related brands | T1 Payments |

| Related individuals | Donald Kasdon (US) Debra Karin King aka Debra Karen Kasdon (US) |

| PayCom42 rating | Orange (Pixxles on PayCom42) |

Share Information

If you have any information about Pixxles, and its activities, please share it with us through our whistleblower system, Whistle42.