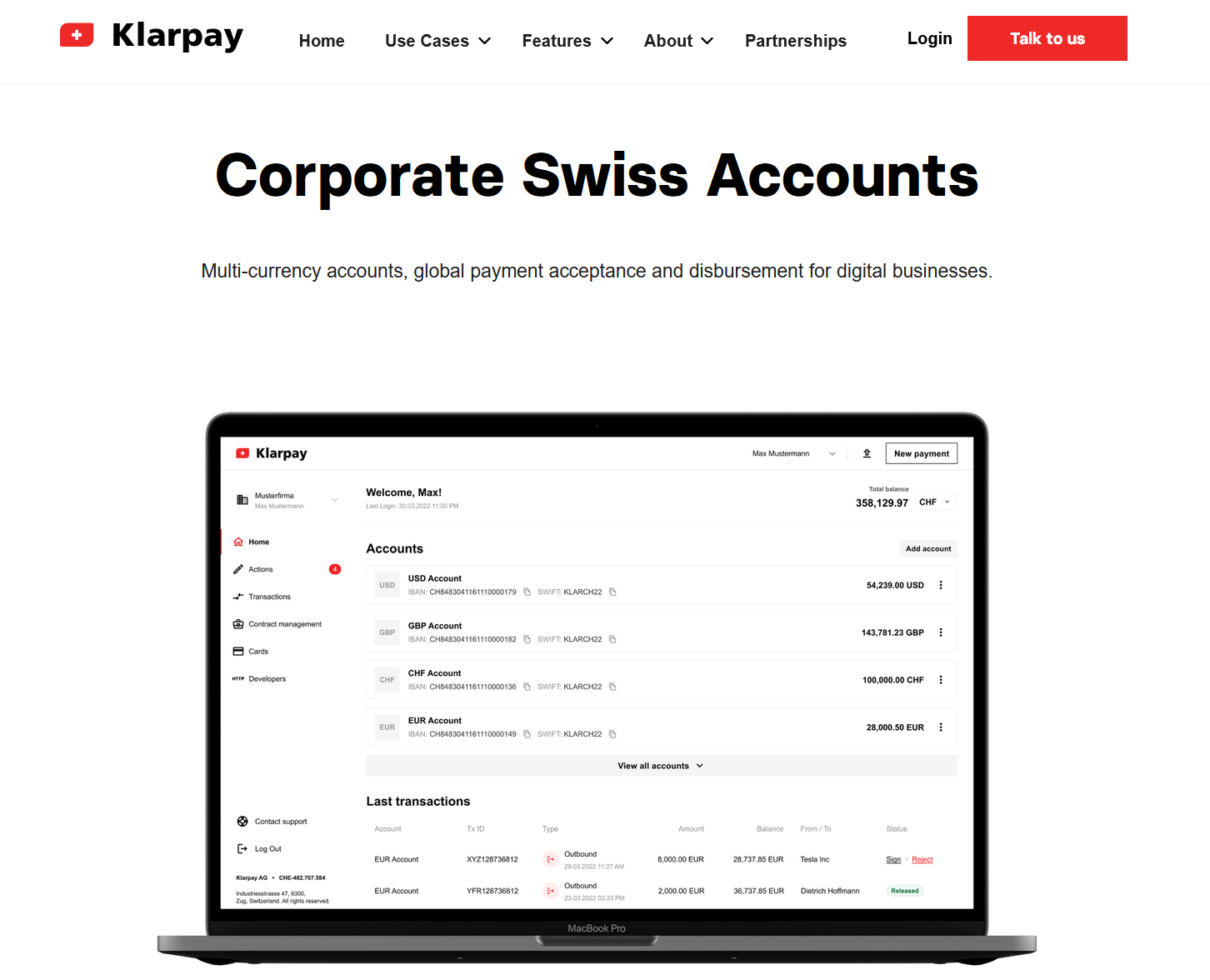

Regulated Swiss fintech Klarpay announced a significant improvement in its services, enabling clients to create Visa debit cards denominated in U.S. Dollars and linked to Corporate USD accounts. This enhancement aims to revolutionize the way Klarpay clients conduct transactions with popular services, such as Google, Facebook, and Amazon Web Services, which often charge in USD, by eliminating foreign exchange costs.

Responding to the rising demand for USD-denominated cards, Klarpay acknowledges the growing needs of advertising affiliates and media buyers who extensively utilize Google Ads or Facebook for their advertising campaigns. This growing trend is driven by numerous factors, including the prevalence of ad campaigns being denominated in USD. By empowering Klarpay clients with USD-denominated Visa debit cards, the company seeks to cater to their specific requirements and elevate their overall financial experience.

The introduction of USD-denominated Visa debit cards offers significant advantages to Klarpay clients. Previously, when conducting transactions with popular U.S.-based companies using their local currency, clients incurred FX costs, leading to additional expenses. However, with this new feature, Klarpay clients can seamlessly spend USD with these renowned companies, eliminating the hassle of currency conversion fees, optimizing their financial operations, and enhancing their overall transactions.

According to Martynas Bieliauskas, Klarpay CEO, “Klarpay remains dedicated to providing innovative solutions that streamline financial processes for our global clientele. The introduction of USD-denominated Visa debit cards marks another milestone in our mission to empower businesses and individuals with best-in-class solutions for managing and scaling their online businesses.“

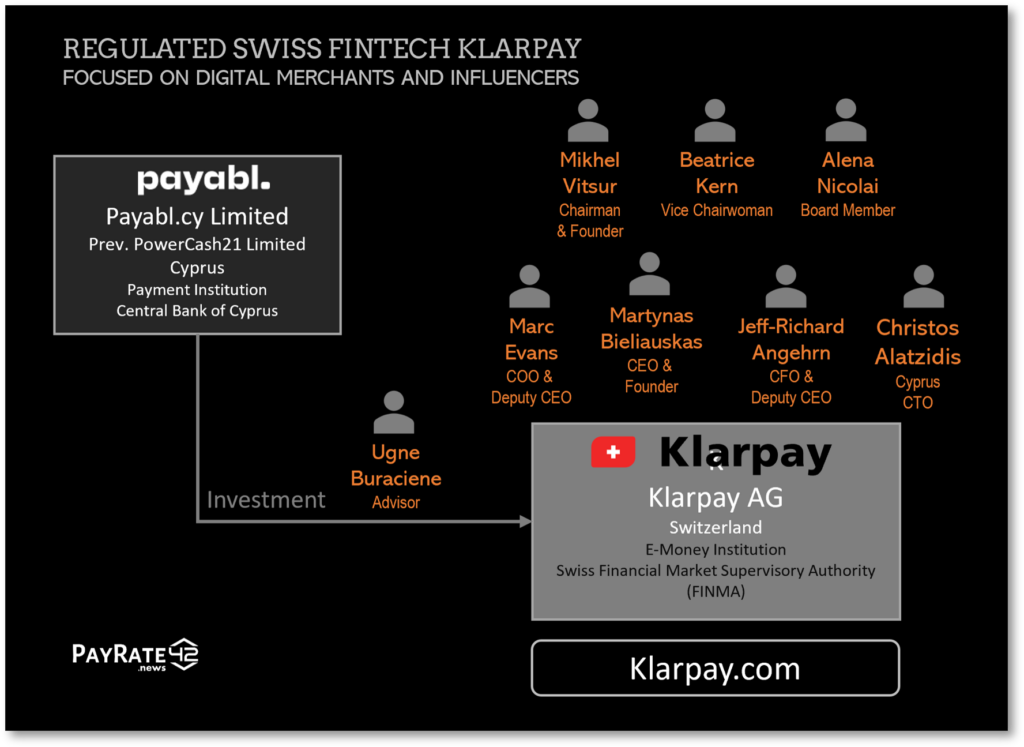

Klarpay received an investment of CHF 3 million from the German-Cypriot Payabl Group in 2022 to finance the further development of the company.

Klarpay AG looks like a sort of spin-off of BDSwiss, the investment firm of Jan Eric Malkus. Some of its former executives and founders are key people in fintech:

- Mihkel Vitsur, co-founder and former BDSwiss Chairman, co-founded Klarpay and is its Chairman;

- Martynas Bieliauskas, former director and co-founder of BDSwiss Group, co-founded Klarpay and is its CEO;

- Christos Alatzidis, the former BDSwiss CIO & CTO, co-founded Klarpay and is its CTO;

- The former BDSwiss Chief Financial Officer Marc Evans joined Klarpay in Feb 2022 as Chief Financial Officer.

Until recently, Payabl did business as PowerCash21. The former Wirecard managers and partners Ruediger Trautmann, Ayelet (Fruchtlander) Knoechelmann, Frank Schoonbaert, and the Israeli Nissim Zarfati founded the PowerCash21 Group around 2010 with several legal entities in different jurisdictions.