Currently, there are several lawsuits in Europe from victims of scams run by Payvision customers. It is alleged that Payvision knowingly and intentionally processed and laundered payments for these scams. The Europen Fund Recovery Organization (EFRI) has coordinated and documented these lawsuits. However, it appears that Payvision and its partner in the US, T1 Payments, have even bigger problems there and are facing million-dollar lawsuits and fraud allegations. We will present the cases in detail in the coming weeks.

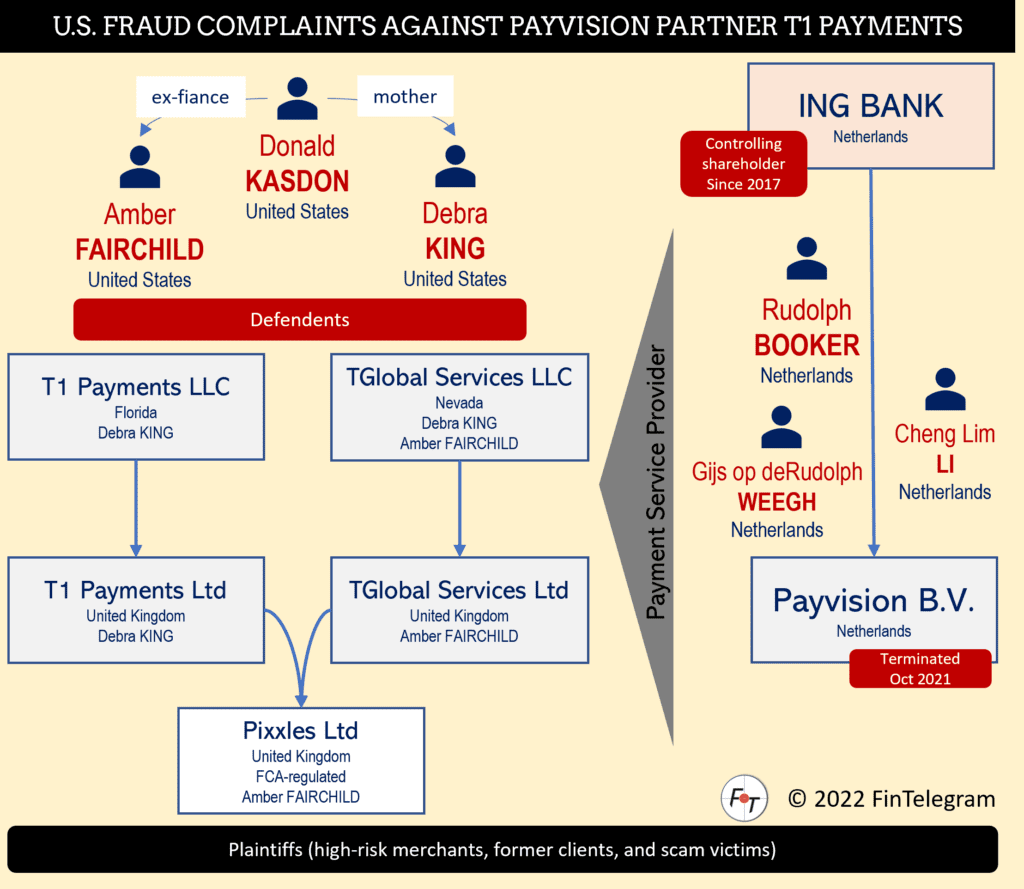

ING subsidiary Payvision was a super-aggressive high-risk payment processor that did not shy away from facilitating cybercrime activities until it was shut down in October 2021. Founded by Rudolf Booker in Amsterdam, the FinTech has worked with Donald Kasdon‘s high-risk processor, T1 Payments, in the United States beginning March 2015 up to the end of May 2021. Payvision and T1 Payments worked out a system that allowed Payvision to hide behind Donald Kasdon‘s group of European sham companies. In the U.S., former customers (merchants) brought fraud lawsuits. Let’s unfold the story!

The Related Parties

| Court cases | U.S. Merchants v T1 Payments et al European scam victims v Payvision et al |

| Jurisdiction | United States United Kingdom European Union |

| Related entities | T1 Payments, LLC T1 PAYMENTS LIMITED, (UK) TGLOBAL SERVICES LIMITED, (UK); TGLOBAL SERVICES Limited, Isle of Man ING (Netherlands) PAYVISION B.V. (Netherlands) PIXXLES Ltd (UK) |

| Related individuals | RUDOLF BOOKER (Netherlands) DONALD KASDON (US); DEBRA KAREN KING aka DEBRA KAREN KASDON (US) AMBER FAIRCHILD (US); |

T1 Payments is essentially a family business run by Donald Kasdon, his mother, Debra King a/k/a Debra Kasdon, and his former fiance Amber Fairchild. According to the UK Companies House, Debra King is the controlling person of the two (dormant) UK entities, T1 Payments Ltd and TGlobal Services Ltd.

In 2018, Amber Fairchild established the FCA-regulated e-money institution Pixxles Ltd in the UK. U.S. lawsuits allege that T1 Payments transferred assets into Pixxles.

The U.S. Cases

The following lawsuits and fraud allegations against T1 Payments are related to Payvision. In all of the allegations, the former customers claimed they were defrauded by wrongfully withheld funds.

In a statement by Donald Kasdon to FinTelegram, Kasdon denied all allegations of fraud but noted that Payvision and ING were aware of the high-risk transactions as well as of the special onboarding requirement for the high-risk merchants (setting up British sham companies). Allegedly, according to Kasdon, even ING’s risk management was actively involved.

The processing of the cannabis, porn, and other questionable business addressed in the court proceedings took place between 2018 and May 2021 – even after Rudolf BOOKER had to leave the company. All these U.S. lawsuits against T1 Payments were filed after ING was already the controlling shareholder of Payvision and largely relate to activities during the “ING Period.” Some of the lawsuits have already been settled, but to see the pattern, we have included them as well.

| Merchant | Description | Claim Volume |

|---|---|---|

| New U Life Corporation | Fraud allegations (Case No. 2:19-cv-01816-APG-DJA) concerning the payment of; | $1,451,000 |

| Onyx & Rose LLC | Fraud allegations (Case No. 2:20-cv-00008-KJD-NIK) concerning a payment processing agreement for cannabis products. | $204,859.51 |

| PureKana LLC | Fraud allegations (Case No. 2:19-cv-01399-KJD-NJK) concerning a payment processing agreement for CBD products. | $1,080,000 |

| Herbal Remedies LLC | Case No. A-20-821474-C. | |

| HANNAVAS Enterprises LLC | Fraud allegations (Case No. 2.20-cv-00411-KJD-VCF) regarding a payment processing agreement for online stores for cannabis products. | $1,000,000 |

| Beyond Wealth PTE LLC | Fraud allegations concerning a payment processing contract for a multilevel marketing system (MLM). | $4,000,000 |

| IBUUMERANG LLC | Fraud allegations (Texas Case 2:21-cv-01611-JCM-VCF) regarding a payment processing contract for a multilevel marketing system (MLM). | $6,000,000 |

| GAIA Ethnobotanical LLC | Fraud allegations (Case 2:22-cv-01046-CDS-NJK) concerning a payment processing contract for the trade of KRATOM (drug). | $400,000 |

| First Capital Venture Co. d/b/a Diamond CBD, Ltd. | Fraud allegations by (Case No. A-21- 834626-B) concerning a payment processing contract for the trade of cannabis. | $600,000 |

All of the plaintiffs are so-called high-risk merchants dealing in industries or with products that are classified as high-risk, like the sale of cannabis, multilevel marketing systems, or KRATOM. Plaintiffs all point out that T1 Payments, and by extension Payvision, knew about the high-risk nature of their merchants when they entered into the Payment Processing Agreements. Obviously, nothing was hidden. They also had to pay correspondingly high fees and accept high rolling reserves.

In Europe, Payvision (without T1 Payments) acted similarly, withholding funds from their scam customers, knowing they could not fight back. We will explain this in detail in the course of our reporting. Stay tuned.

Share Information

If you have any information about T1 Payments or Payvision, or if you are a merchant also experiencing issues with these payment processors, please let us know via our whistleblower system, Whistle42.