Yes, the UK Courts ordered the compulsory wind-up of iPayTotal Ltd. A fact. Nevertheless, it is always somewhat challenging to expose cybercrime and scam-facilitating high-risk payment processors (HRPP). They tend to send lawyers to claim defamation and threaten to sue. Sure, these HRPPs make enough money for good lawyers with their high-risk business practices. Well, challenge accepted. Apparently, the UK-Indian HRRP iPayTotal also feels defamed by FinTelegram’s reports and wants them offline. Sure they want! Purportedly, we did not name or explain the sources. Well, here is a summary of the fact-based allegations. We also refer to the iPayTotal listing on High-Risk Payment Processors Report.

The FinTelegram reports have combined the results of their own research with allegations made public on other review sites and in Internet forums. Here are the findings again:

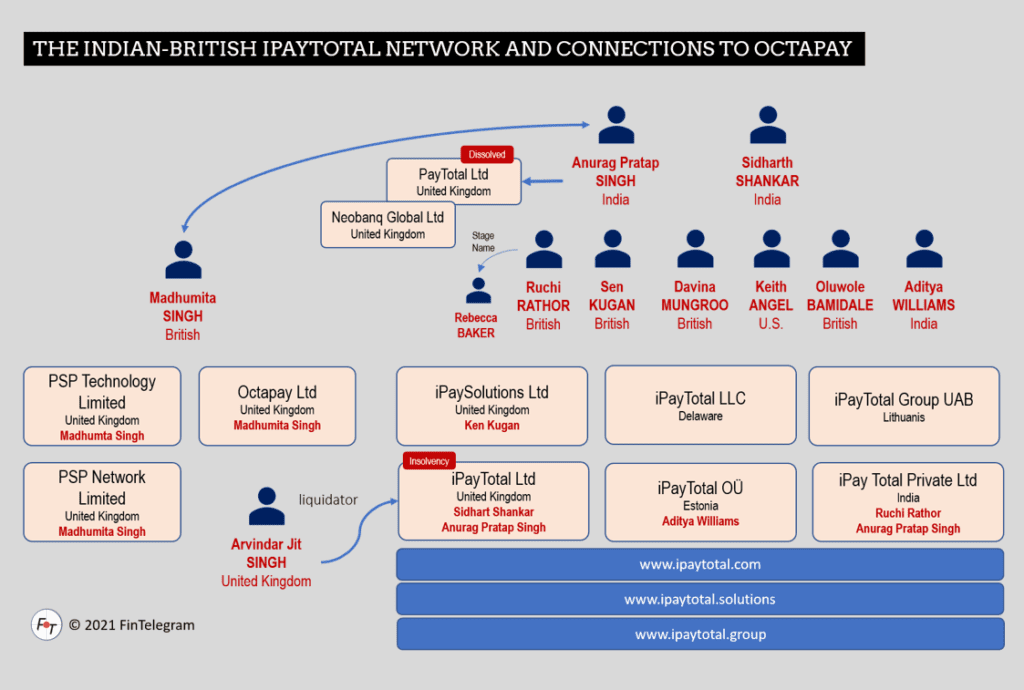

- Count 1- Insolvency Case and Court Order: the UK iPayTotal Ltd wanted to be struck off Companies House. A creditor who did not receive his money objected to this. The High Court of Justice upheld the objection and ordered the company to be wound up under the UK Insolvency Act 1986. On December 3, 2020, Arvindar Jit Singh of FRP Advisory Trading Ltd, Birmingham, was appointed liquidator on January 6, 2021. The company must now be compulsorily wound up. No defamation here.

- Count 2 – iPayTotal Scam Facilitation: this finding is based on victim reports, whistleblower reports, and our own research. We have analyzed numerous scams against which financial market regulators have issued warnings. iPayTotal regularly appears in them. The evidence is easy to provide using screenshots and payment documents: no defamation, but hard facts.

- Count 3 – Ripping off merchants: some rip-off accusations are raised against iPayTotal publicly in forums. They are said to sort of forfeit money from their customers (high-risk merchants or scams) or even blackmail them. A good example of this kind of public discussion can be found here in the OffshoreCorpTalk forum. Phillip Parker has also published a harsh review on CardPaymentsOptions to this effect, stating more than 50 complaints. Thus, iPayTotal’s business practices, including very high fees, suddenly closed merchant accounts, and forfeited funds, are publicly known away from FinTelegram. Not defamation, but publicly available information with sources.

- Count 4 – iPayTotal and Octapay: the allegation that the same beneficial owners are behind the new HRRP Octapay as behind iPaytotal was made by the former director of Octaypay, Christian van Biezen (LinkedIn profile). A written statement is available to FinTelegram, and we have no reason to doubt the statements. Not defamation, but report with credible testimony and double-checked facts.

iPayTotal has recently presented itself with a new president and frontman in Sen Kugan (LinkedIn profile). Actually, he seems to be a sympathetic person and has no negative public record. However, a new president cannot make facts disappear either.

We repeat our warning from iPaytotal and also refer to the report in the High-Risk Payment Processors Report.