We have been following the activities of the Cypriot high-risk payment processor Payabl since times when the company was still called PowerCash21. Since former Wirecard executives founded the company, it naturally enjoys attention. Measured with Similarweb data, 2022 was apparently a fantastic year for Payabl, with growing visits from the porn, gambling, and investment industries. Most recently, we found CySEC broker BDSwiss and the online casino Golden Star as payable clients.

The Update

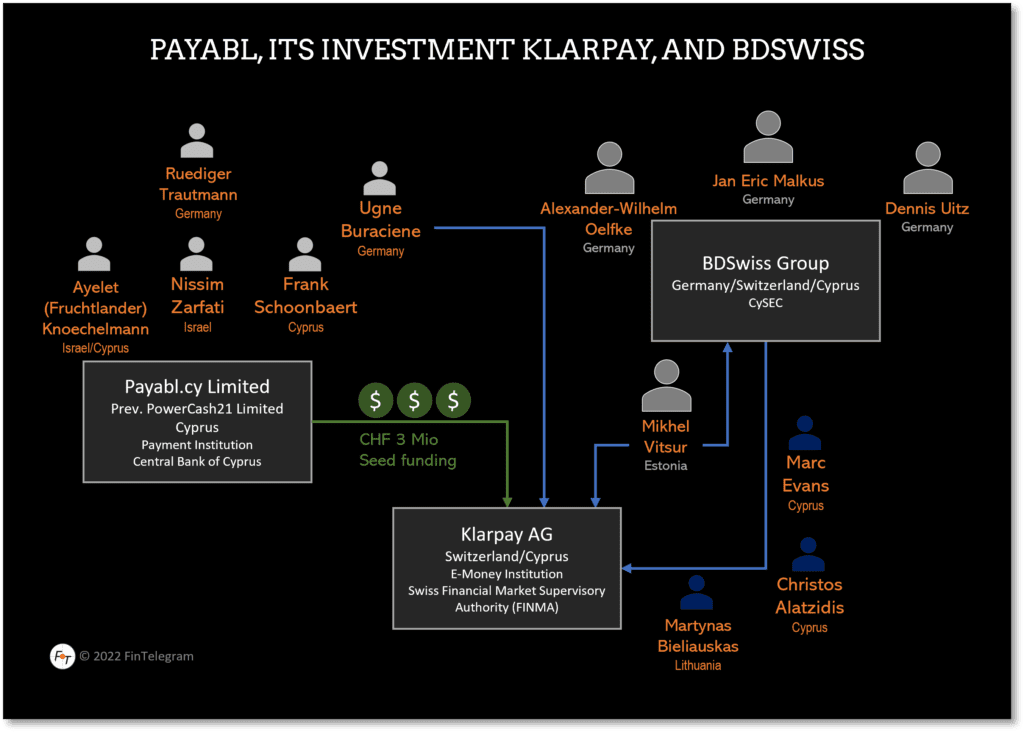

It is no surprise that BDSwiss settles its payments through Payabl. Both companies are dominated by Germans who know each other well. On the one hand, BDSwiss owner Jan Malkus and, on the other hand, Dietmar Knoechelmann and Ruediger Trautmann as the beneficial owners behind Payabl. In Q2 2022, Payabl raised a CHF 3 million financing round for the BDSwiss spin-off Klarpay.

The Golden Star casino, too, is no surprise either. As reported, we have already identified other Dama N.V. casinos as one of the Payabl customers. Since Cypriot Friolion Ltd acts as a payment agent for Dama, The Cyprus-regulated payment processor Payabl is a logical choice.

Share Information

If you have any information about Payabl, its partners, and customers, please share it through our whistleblower system, Whistle42.