In the second day of the Wirecard trial, defense attorneys delivered their opening statements. As expected, the defense attorney of former CEO Markus Braun argued that the controversial Third-Party-Acquiring (TPA) had taken place. On the other hand, the defense counsel of Oliver Bellenhaus, who is the prosecution’s key witness, claimed that the TPA businessdid not exist. We are certain that the largely dirty TPA business did exist and that many illegal transactions and scams were conducted via it.

All the people who searched for the real TPA business were unsuccessful. No one found the real cause, and no one will find it. There are no customers who have made claims until today.

Florian Eder, defense lawyer of Oliver Bellenhaus.

The Early Wirecard

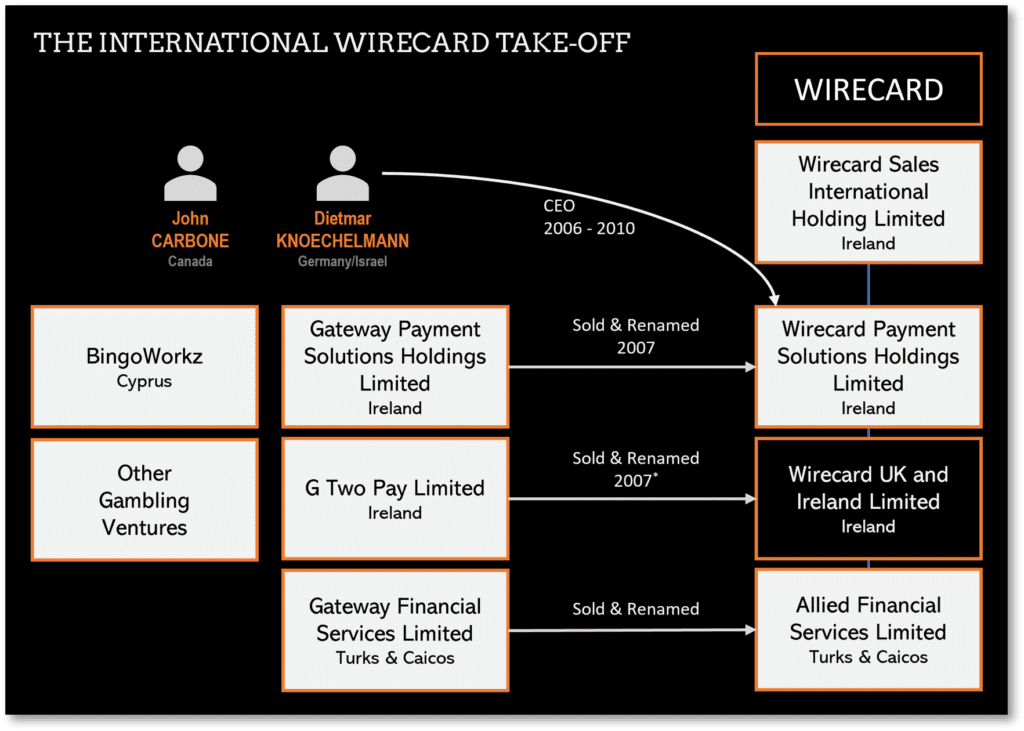

You can only understand a system or how an organization like Wirecard works if you go back to the beginning. You have to try to understand how Wirecard was designed and by whom. From our point of view, the beginnings of the international Wirecard business and thus also the emergence of the TPA network as part of a shadow organization in Ireland lie in the years 2007 to 2012.

In this embossing phase, the two top Wirecard executives at the time, Ruediger Trautmann and Dietmar Knoechelmann, shaped Wirecard and positioned it as a player in the dark to black high-risk segment. A shadow organization including a TPA network was also developed for this purpose.

Knoechelmann, for example, became the CEO of Wirecard Payment Solutions and hooked payment volumes from US gambling, which was already banned at the time, into Wirecard. Knoechelmann, a German man who married an Israeli woman, Ayelet Fruchtlander Knoechelmann, and is now a German-Israeli dual citizen, was convicted in Israel in November 2016 of abetting fraud in the ICC-Cal money laundering scandal.

The Irish TPA Network

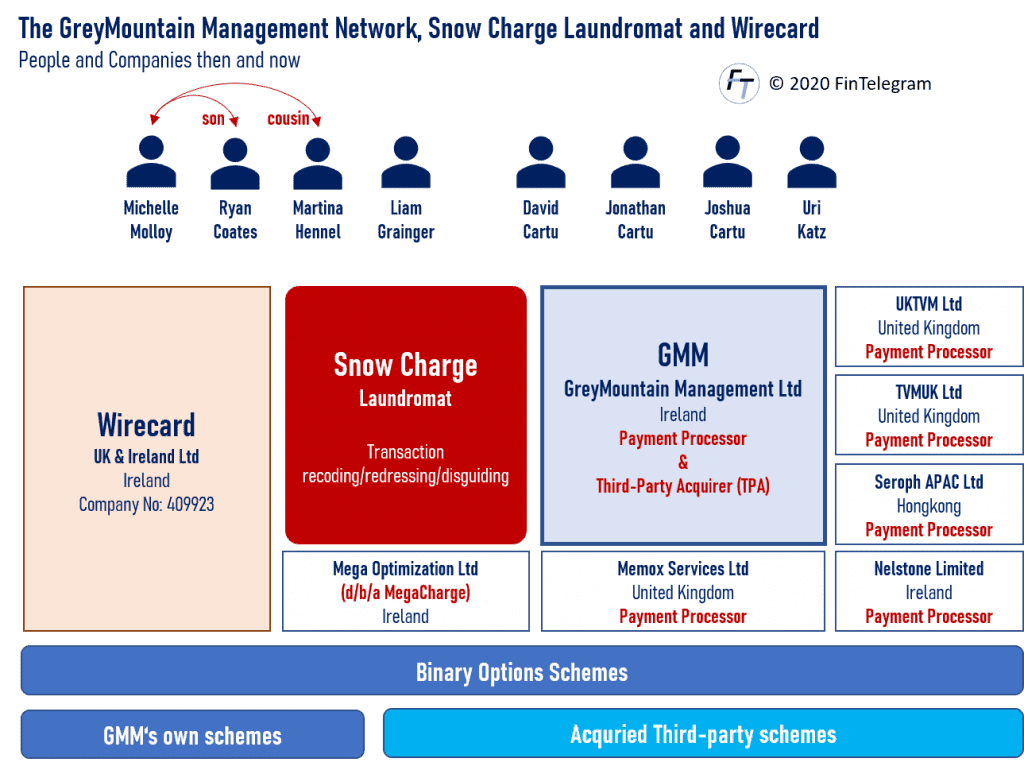

Under Dietmar Knoechelmann, Michelle Molloy was appointed as Director of Wirecard Ireland & UK. She was subsequently also responsible for the partnership of GreyMountain Management Ltd (GMM), also registered in Ireland. Both companies had their registered offices in Ulyssis House in Dublin.

GMM was founded and run by Canadian-Israeli national David Cartu, was a TPA for Wirecard and has operated as a payment processor for binary options scams. The son of then Wirecard director Michelle Molloy, Ryan Coates, served as a director at GMM. Between 2013 until the liquidation of GMM in 2017, hundreds of millions of Euros were processed and laundered for binary options scams.

This partnership also used a type of money laundering software called “Snow Charge,” which was designed to recode and disguise payment processes.

In our view, GMM is both a concrete example of the existence of the TPA network and the shadow organization surrounding Wirecard. GMM and Wirecard in Ireland also show very nicely the personnel connections, the sharing of offices and the close economic and technical ties between Wirecard and external partners.

Share Information

If you have any information about Wirecard, its partners or the TPA network, please let us know via our whistleblower system, Whistle42.