A victim has provided documents to FinTelegram that are included in the criminal files surrounding the Broker scams GetFinancial, o4trade, Fivecircles, and others. Authorities have traced the money from victims to ultimate recipients over and have also discovered the facilitating payment processors. Besides the notorious illegal German payment processors like SecurePort GmbH, they also found advCash, MoneyNetInt, DIXIPAY, and the regulated Cypriot e-Money Institute SEPAGA E.M.I. Limited.

Key Data

| Trading name | SEPAGA |

| Business activity | Regulated e-Money Institution |

| Domain | www.sepaga.com |

| Legal entity | SEPAGA E.M.I. Limited, Cyprus |

| Jurisdiction | Cyprus |

| Regulator | Central Bank of Cyprus (license No. 115.1.3.18/2018) |

| Related individuals | Elena Kontou , CEO(LinkedIn) Sophocles Sophocleous, CFO (LinkedIn) Ioannis Petrou, CTO (LinkedIn) Kyriacos Symeou, CO (LinkedIn) Panayiota Photiou (LinkedIn) Scott Wilson, director until June 2022 (LinkedIn) |

| Connections | StronIT, SecurePort GetFinancial, o4trade |

| PayRate42 | SEPAGA profile on PayRate42 |

Short Narrative

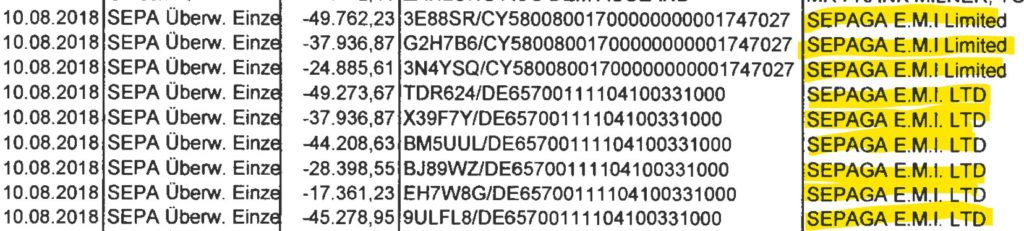

It is clear from the documents we reviewed that the operators of the scams, such as GetFinancial or o4Trade, were clients of SEPAGA E.M.I. Limited. SEPAGA, in turn, maintained accounts with Deutsche Handelsbank and Cypriot AstroBank. To these accounts, the scammers received the funds stolen from the customers.

According to the authorities’ findings, the victims did not always deposit their funds directly into the SEPAGA accounts of the scammers but often via illegal payment processors such as StronIT or SecurePort, which then transferred the money in larger tranches to the SEPAGA accounts.

Share Information

If you have information about SEPAGA, its operators and partners, please share it with us through our whistleblower system, Whistle42.